Exclusive: Electric car insurance now cheaper than petrol. And these are the cheapest EVs to insure

We reveal the cheapest and most expensive EVs to insure as average premiums drop below ICE prices

Electric cars are now on average cheaper to insure than petrol vehicles, according to exclusive new data provided to EV Powered.

Figures shared with us by leading comparison service Go.Compare show that the average quoted premium for an EV is now £45 lower than for a petrol-powered vehicle.

In July 2024 the average quote for fully comprehensive EV insurance was £832, compared with £877 for a petrol car, disproving the myth that electric car insurance is more expensive than for other fuel types, and adding to the lower running costs EV owners enjoy.

While insurance costs have risen across the board in recent years, using four years’ worth of quotes for fully comprehensive cover, we can reveal that average EV premiums have risen 50.7% while petrol premiums have shot up 67%.

The average quote for a petrol car on Go.Compare overtook that for an EV in October 2023, when petrol premiums hit £979, compared with £937 for electric. EV quotes have remained lower as prices have begun to fall for both fuel types since early 2024.

Tom Banks, car insurance expert at Go.Compare, said: “It’s interesting to see that, despite the perception of EVs being more expensive to insure, the latest figures show that they’re actually cheaper to cover than conventional petrol vehicles.

“Around September last year, the average comprehensive policy price for petrol cars overtook the price for EVs, to the point where cover for EVs is now around £45 cheaper.

“Clearly, the widespread opinion on this issue isn’t quite in touch with what’s happening in the market, so if you’re considering an EV for your next car, try not to be put off by insurance prices. In fact, car insurance prices on the whole have dropped by 2% between April and June from the start of the year.

“Prices are still higher than last year though, so to help keep your costs as low as possible, remember to compare policies and look out for the providers that give you the best deal.”

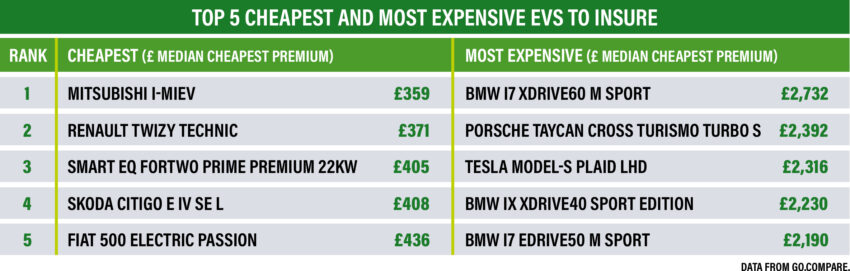

The cheapest and most expensive electric cars to insure

While our exclusive figures are good news for EV owners, they also reveal major differences in costs for different models, ranging from around £300 to almost £3,000.

The single cheapest EV to insure, according to Go.Compare’s data, is the Mitsubishi i-Miev. The pioneering but peculiar model, which was sold from 2009 to 2014 and had a range of less than 100 miles, had an average cheapest quote of £359 per year to insure.

Just behind it is another oddball in the shape of the Renault Twizy, costing £371 to cover. Various versions of the Smart EQ ForTwo also feature on the list of the cheapest EVs to insure, along with multiple iterations of the electric Fiat 500 and the Skoda Citigo, all of which attracted premiums of under £500.

At the other end of the scale, the BMW i7 XDrive 60 proved to be the most expensive EV to insure. The average lowest quote for the £100,000+ luxury limo was £2,732 for the range-topping model in M SPort trim.

Behind that, the 939bhp Porsche Taycan Turbo S Cross Turismo was the second most expensive to insure at £2,392. Anyone brave enough to import a left-hand drive Tesla Model S Plaid also faces a bill in excess of £2,300.

Other specifications of the i7 and the Taycan also appear in our most expensive list, along with the high-performance Audi e-tron GT and Lotus Eletre, and the Mercedes-Benz EQE, with prices between £1,933 and £2,230.

Mainstream winners and losers

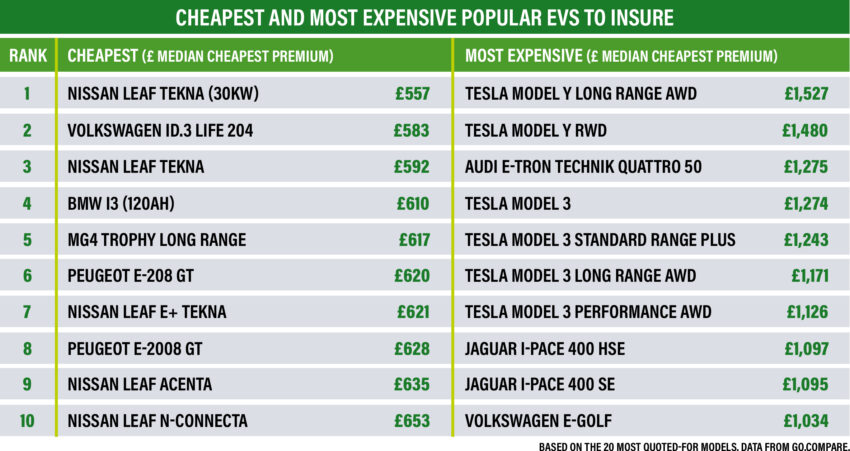

Given that many of those extreme prices are for hyper-exclusive models or cars that are no longer on sale, we thought it was worth getting a more mainstream picture as well. So we asked Go.Compare for data on its 20 most popular models by volume of quotes.

Of the 20 most-searched-for models, the first-generation Nissan Leaf proved to be the most affordable to insure, with a price as low as £557 for the pioneering EV in Tekna trim.

Close behind that was the Volkswagen ID.3, with a premium of £583, and the new Leaf Tekna at £592. The late-model BMW i3 sits fourth, at £610, while the MG4 is, ironically, fifth on our list (£617), ahead of the Peugeot e-208, three more versions of the Leaf and the Peugeot e-2008.

At the opposite end of the scale, Tesla dominated the list of most expensive popular models, with various versions of the best-selling Model Y and Model 3 occupying six of the spaces in the top 10.

The most expensive ‘mainstream’ model is the Model Y Long Range AWD, which comes in at a minimum of £1,527 per year. The standard rear-wheel drive Y is next on the list at £1,480, ahead of the Audi e-tron Quattro 50 at £1,275. Beneath that are four variants of the Model 3, costing between £1,126 and £1,274 minimum, with Jaguar’s I-Pace occupying the two more spots in our top 10 ahead of the VW E-Golf.

Teslas have developed a reputation for being expensive to insure for a number of reasons. The use of large single-piece panels means minor bumps can require complex and expensive repairs, and parts availability has been patchy, leaving insurers facing long-term courtesy car bills. On top of that, their relatively high performance and fears over their security push them up the insurance groups.

With so much of the list dominated by Tesla, we thought it would be interesting to see what were the most expensive alternatives, by stripping the American brand out of the data. That revealed that the Audi e-tron and Jaguar I-Pace are joined by various iterations of the Mercedes-Benz EQC, which cost between £1,111 and £1,199, as well as the Volkswagen E-Golf (£1,034) and top-specification MG ZS Exclusive (£676).

So, while some EVs are still pricey to insure in the same way that high-performance or complicated petrol cars are, it seems that insurance is another area where EV owners can enjoy savings over their petrol-driving counterparts.