UK drivers face postcode lottery on public charging

UK drivers continue to face massive regional divides in public electric car charging.

Infrastructure continues to expand in virtually all parts of the country, but new figures from the Department for Transport (DfT) show some regions are still lagging far behind others, leaving drivers facing a postcode lottery of provision.

The latest quarterly data from the DfT and ZapMap shows that the roll-out has slowed slightly since the first quarter of the year, growing 8% between April and July – down from 11% growth between January and April.

A total of 4,962 new chargers were installed between April and July, taking the UK’s total to 64,632 – a 47% increase over July 2023. Only one region – England’s North-East didn’t see a rise in the number of chargers.

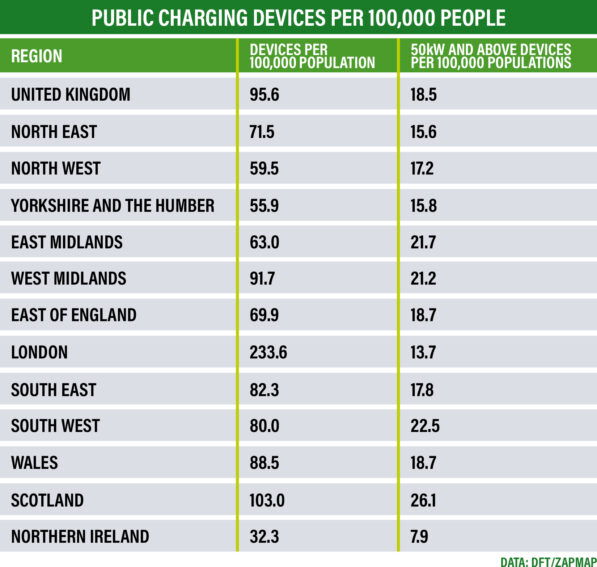

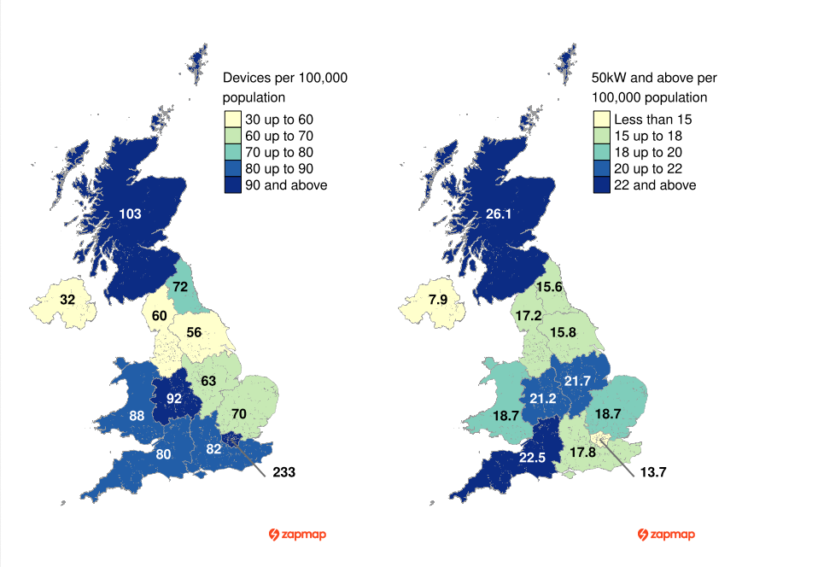

On average, the UK now has 96 public EV chargers for every 100,000 people – up from 89 in April – but the figures show massive variations. Londoners are far better catered for than in any other region, with 234 devices per 100,000. Drivers in Scotland are next best served, with 103 devices per 100,000 population, and those in the West Midlands enjoy 92 chargers per 100,000.

At the other end of the scale, Northern Ireland lags far behind every other part of the UK, with just 32 devices per 100,000 people. That is despite a 13.4% jump in charger numbers over the last three months.

Also trailing far behind are Yorkshire and the Humber, with just 56 devices per 100,000; England’s North West (60 per 100,000) and the East Midlands (63 per 100,000).

The uneven distribution of chargers is partly down to council attitudes towards infrastructure. A survey of local authorities in March found that one in three had no fixed strategy for EV infrastructure and just 18% had staff dedicated to delivering local roll-out.

Council backing is seen as vital to helping deliver the predicted 300,000 chargers needed to meet demand by 2030. But authorities say that money worries and planning confusion are getting in the way of them supporting infrastructure development.

The study by charging operator Believ found that three-quarters said a lack of public funding and delays in releasing cash from schemes such as England’s Local EV Infrastructure (LEVI) Fund were the biggest obstacle. However, some also said that they could not justify spending on EV infrastructure in areas where very few people drove electric cars.

ChargeUK, which represents the country’s main chargepoint operators, also warned that delays to funding for local councils from central government could put the 2030 target in jeopardy.

It recently said it believes the country is on track to meet the 2030 goal but that the government needs to do more to help private operators expand their networks in the face of funding delays and planning difficulties.

As well as showing overall charger provision, the data also breaks down provision by type of charger and reveals that a large proportion of London’s devices are slower-speed kerbside units. Although it leads the way in overall provision, there are just 13.7 high-speed (50kW) chargers per 100,000 in the capital – the second lowest ratio after Northern Ireland, which has just 7.9 per 100,000. In contrast, Scotland has 26.1 per 100,000 and the East Midlands, which lags behind in overall provision, has 21.7 50kW+ devices per 100,000 people.

Overall, the split of chargers between slow and rapid devices has remained steady, with the fastest devices representing the smallest proportion. Slow (3-8kW) devices account for 60% of all chargers at the start of July, with 8-49kW chargers representing another 21%. Rapid (50149kW) made up 11% while ultra-rapid devices (150kW+) made up just 8%.